Contents

- 1 Saving money for something special? Need a budget reset? Tired of the guilt after irresponsible spending habits? Never have enough to get by? Need to cut the budget because of loss of income? If so, try one of these money saving challenges to reset your money mindset and start saving.

- 1.1 15 Money Saving Challenges

- 1.2 52 Week Money Saving Challenge:

- 1.3 Generic Brand Challenge:

- 1.4 No Spend Challenge:

- 1.5 Weather Wednesday Saving Challenge:

- 1.6 Spare Change Challenge:

- 1.7 100 Envelope Money Saving Challenge:

- 1.8 Discount Challenge:

- 1.9 8 Week Vacation Saving Challenge:

- 1.10 Automatic Money Saving Challenge:

- 1.11 Save the Difference Challenge:

- 1.12 The Pantry Challenge:

- 1.13 14 Day Money Saving Challenge:

- 1.14 No Eating Out Challenge:

- 1.15 $5 Money Saving Challenge:

- 1.16 $1,000 Emergency Fund Challenge:

Saving money for something special? Need a budget reset? Tired of the guilt after irresponsible spending habits? Never have enough to get by? Need to cut the budget because of loss of income? If so, try one of these money saving challenges to reset your money mindset and start saving.

This comprehensive guide features 15 money saving challenges that will help you save.

Instead of needing to create a new habit or discipline, doing a challenge makes saving your money so much more fun.

15 Money Saving Challenges

If you are a homeschooling or a stay at home mom you are always looking for ways to cut corners and save money. These are some of the best ideas to start. Try one or try them all, it’s totally up to you! Share these tips with your friends and family. Having support and accountability in every new thing gives you an extra boost to follow through.

Saving money, especially when you have kids, can be difficult. I have compiled a list of 15 money saving challenges that will hopefully make it easier for you to save money, without giving up the things you love!

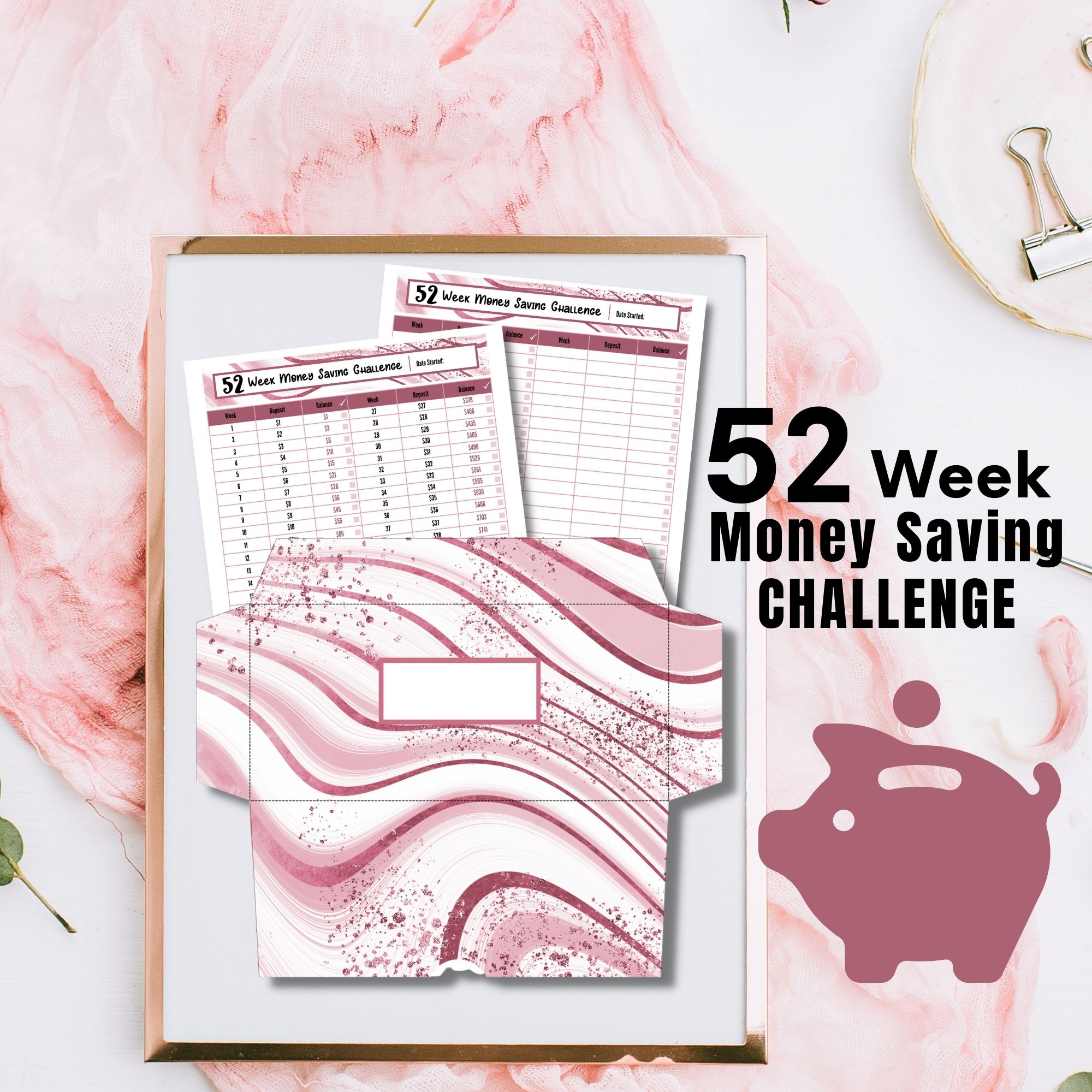

52 Week Money Saving Challenge:

This challenge aims to help you save more and more as the weeks go on. This helps ease you into learning how to save. You add a dollar a week, starting week 1 with saving $1, then moving on to saving $2 week 2, on and on until you reach week 52. In total, you will save $1,378! Click here to get everything you need to start this challenge!

Use this 52-week Money Saving Challenge tracker to save for those unexpected expenses and avoid debt overwhelm.

Generic Brand Challenge:

For this challenge, you spend a month buying only generic brands. This is a great way to learn which items are exactly like the name brands, and a great way to save money at the same time! To learn more about the challenge head over to Deft Free Forties.

No Spend Challenge:

The no spend challenge is pretty self explanatory. You choose a period of time, maybe a month, to not buy anything unnecessary. Before you start the challenge, you should make a list of things that you will permit yourself to buy, such as groceries or other necessities.

This is a great challenge to help you realize what things you actually need to spend money on, and what you can skip out on. I’ve also heard it called a spend fast. In a fast you are denying yourself of something, in order to grow or reach a personal goal. I love how Heather from Momforallseasons.com explains it.

Weather Wednesday Saving Challenge:

For this challenge, you spend a year saving the amount of the high temperature in your area each Wednesday. This is a unique challenge, although its difficulty will depend on where you live! For more information check out what Mama and Money had to share.

Spare Change Challenge:

This is a super easy challenge that can be done anytime, and won’t strain your budget. Whenever you get change back at the store, put in into a jar and vow to not touch it for a certain amount of time, such as a year. You will be surprised how much you can save with very little effort using this method! Learn more at Rise Credit.

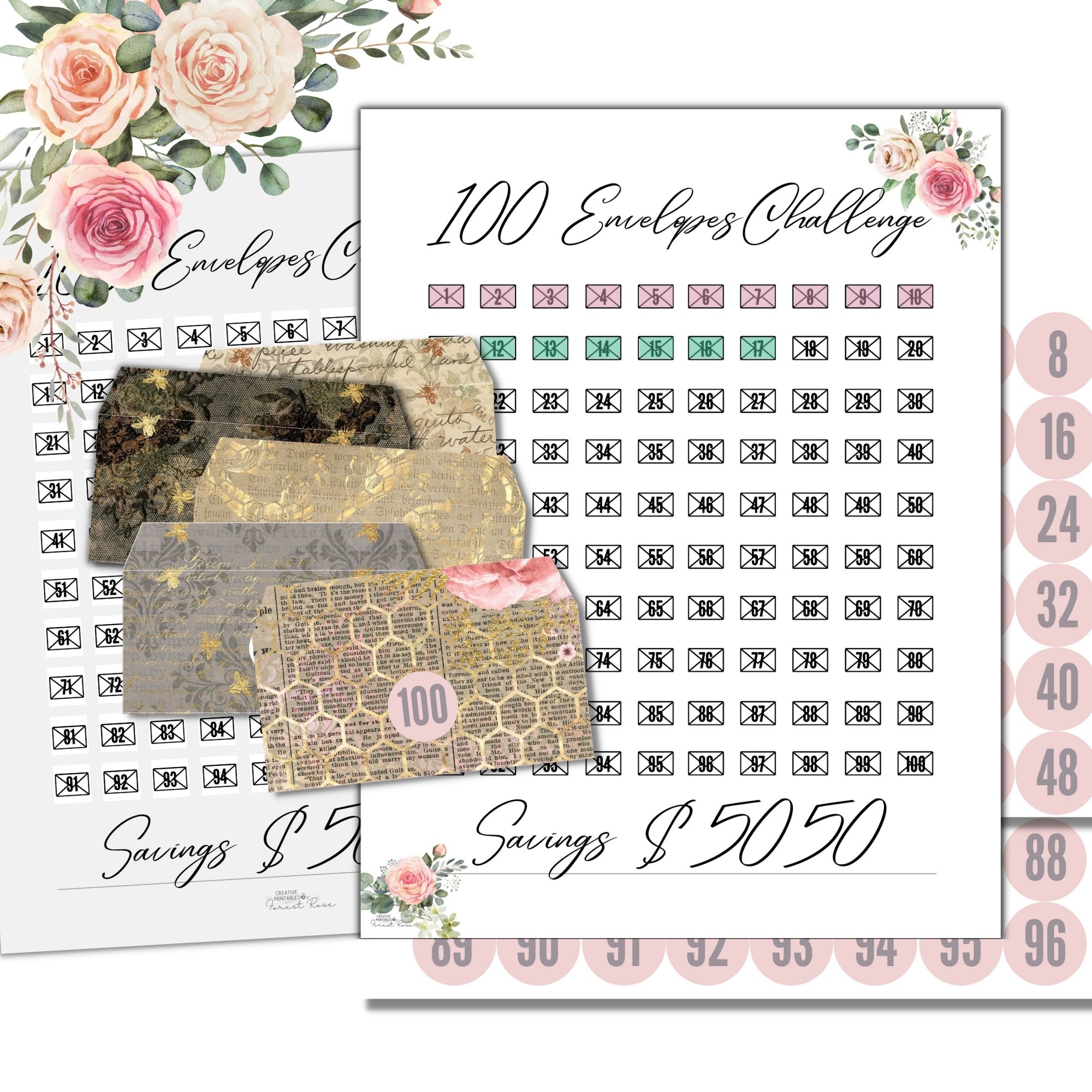

100 Envelope Money Saving Challenge:

Need help getting started saving money for a vacation/ Emergency fund? Money Saving Challenges and Tracker visuals help keep you motivated while you save towards your goals. The 100 Envelope system is so easy and fun!

You will have a nice little nest egg in NO TIME! You got this!

HOW TO USE:

1) Print 100 envelopes. I’ve given you 5 different styles to choose from. If you print 20 of each you will have 100. Cut along outside edge, fold each dotted line starting with the bottom then sides and top. Use packing tape to hold sides in place.

2) Cut out the numbers and glue or tape to the white circle on the front of each envelope.

3) Fill each envelope with cash. i.e #1 put $1, #12 put $12…You can do these in order or randomize.

4) When you put cash in an envelope – color in the reciprocating number on the tracker.

5) Once all the envelopes are filled you should have saved $5,050.

Discount Challenge:

For this one, you spend a week only buying things that are on sale, or that you have a coupon for. This is a great way to learn more about what you really need, and how to, of course, save money! For more information about the challenge go to Debt Free Forties.

8 Week Vacation Saving Challenge:

The goal of this challenge is to save $1,000 in 8 weeks, perfect for saving up for your next family vacation! The saving goal per week is as follows: Week 1 – $10, Week 2 – $25, Week 3 – $75, Week 4 – $150, Week 5 – $150, Week 6 – $75, Week 7 – $25, Week 8 – $10. On top of that, cut out 1 restaurant meal a week and save $400 over the 8 weeks, and cut out two coffee shop visits a week to save $80 over the 8 weeks. More information can be found at Living Lowkey.

Automatic Money Saving Challenge:

This challenge is simple. Just set up an automatic transfer to your saving account for each time you get paid. You can do this with most online banking, and you won’t even have to think about it! Just set an amount to transfer every paycheck. $10, $20, $30…whatever you can do.

Save the Difference Challenge:

As a homeschool mom, I’m always looking for ways to cut corners. We are a one income family, so our credit has taken a hit through the pandemic. Finding ways to save, earn or even get a loan without credit history is top of my list.

This is a relatively easy and simple challenge, but you do need to make sure you have a solid budget in place in order for it to work. If, at the end of the month/ budget period, you have unused money left in your budget, you simply put that money into a savings account instead of spending it on something else. This is a great way to avoid unnecessary spending!

The Pantry Challenge:

The pantry challenge is a great way to save money on groceries and use up what you already have, as well as reduce food waste. The challenge is pretty simple. You decide on a period of time, usually about a month, but it can be more or less depending on what you have. During that time period, you only eat the things you already have in your pantry, fridge, and freezer. You can also decide on what items are still okay to buy, such as milk or fresh produce. This challenge also goes great with the No Spend Challenge!

14 Day Money Saving Challenge:

This challenge is great because it helps prepare you for long term financial success. Each day, there is a small tip on what you can change or learn about your finances, such as learning about your credit card, or practicing discipline. This is a great challenge to learn how to kick start your own financial literacy! Learn more at Money Done Right.

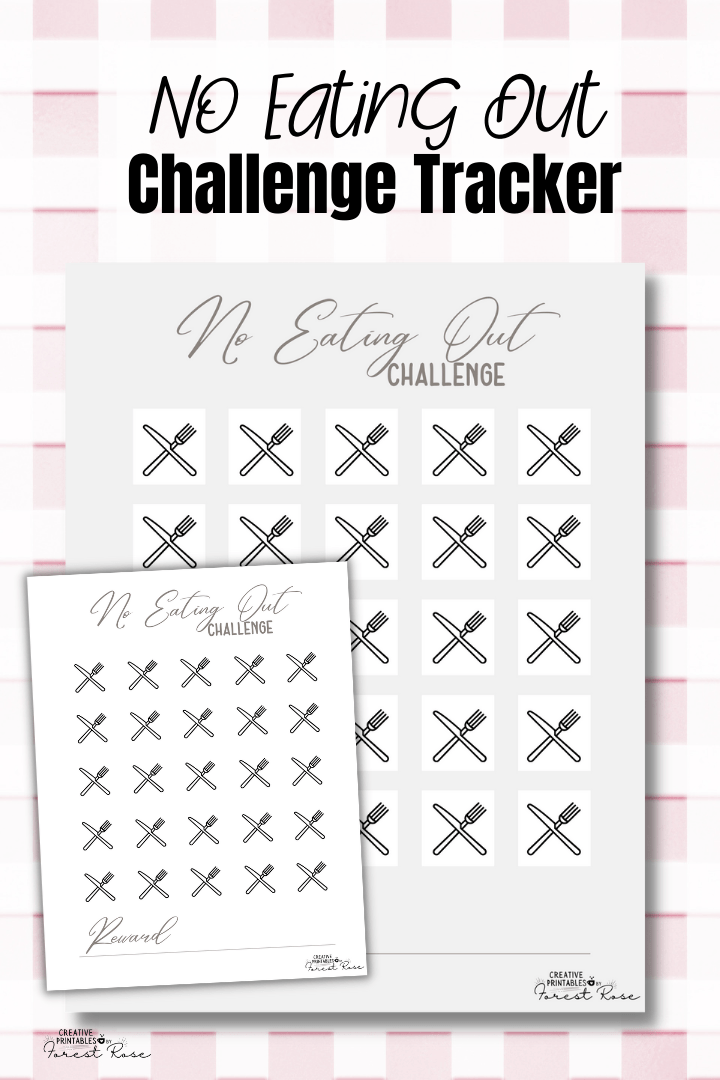

No Eating Out Challenge:

For many people, eating out is a huge area of overspending. Cutting back on, or eliminating, eating out is a great way to quickly save up more money. Set a goal for yourself, such as no eating out for a month, or only eating out once a week. Use a chart or tracker to keep yourself accountable, and stick to it! Grab your No Eating Out Challenge Tracker (FREE for a limited time).

$5 Money Saving Challenge:

This one works well as long as you pay with cash often. Each time you receive change back, you save any $5 bills that you receive. This is easy, and you will be surprised at how much money you can quickly save!

Alternatively, you can pick a different coin or dollar amount. Like save all the quarters you get back in change or dollar bills.

$1,000 Emergency Fund Challenge:

This challenge will help you save $1,000!

We all know life is not always sunshine and puppies. So, why not be prepared for those unexpected expenses that pop up? Flat tire, emergency veterinarian fees, Appliance repairs etc. You just never know.

The main goal is to simply start saving. It may take you 40 weeks OR you may reach the goal in three months. You can save at your own pace.

Having an emergency fund is a great step in helping keep you and your family secure. Although starting to save for emergencies may seem daunting, by starting small and working slowly, it is very doable!

Through a little discipline and consistent healthy money habits you can reach your money goals in no time.

Check out my Emergency Fund Tracker – Free for a limited time! 6 different emergency trackers in this download. -Save $600, Save $1000, Save $2000, Save $3000, Save $4000 and a blank tracker to set your own goal.

Saving doesn’t have to be difficult. Just start small and work toward a goal. If you try out a challenge and it doesn’t work for you or you can’t stay consistent. Start over with a new one.

I know you can do this. Just start bit by bit and before you know it you will have money saved.

For more homeschooling inspiration, tips and encouragement, make sure to follow KFH on Facebook, Pinterest, Instagram and Twitter, and subscribe to our Newsletter for some FREE GOODIES!

Forest Rose is a God Loving, Blessed Wife, & Mama to 3 girls. She’s passionate about lifting moms out of the trenches that are discouraged, overwhelmed, or feeling alone or isolated. Her hope is to point them to Christ and equip them to rise up with a newfound hope and joy within, that He alone can provide. Besides blogging, she also loves to create printables!

Leave a Reply